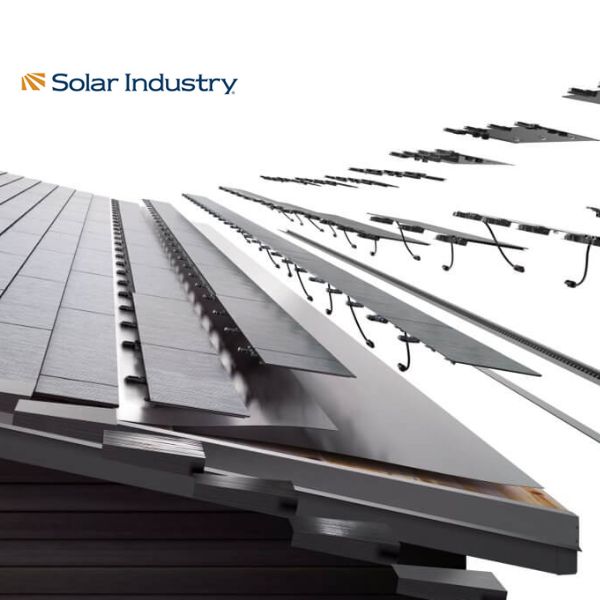

Solar Industry Highlights Renu’s Introduction of Tesla Solar Roof to the Carolinas

Renu Energy Solutions, a locally owned and operated solar installer based in North Carolina and South Carolina, has partnered with Tesla to bring Tesla Solar Roof tiles to the Carolinas.

As the first certified Tesla Solar Roof installer in North Carolina, the Renu Energy Solutions team is now offering residential customers its innovative tiles made with tempered glass three times stronger than standard roofing tiles and engineered for all-weather durability.

Renu is also among only a handful of certified Tesla Solar Roof installers in South Carolina.

To continue reading Solar Industry’s article written by Ariana Fine, click the here!