Commercial Solar for your Business

01

Savings

Saving money on energy costs means your business can lower operating expenses and improve its bottom line. While every business is different the savings from a solar investment lasts in the long term- thus taking advantage of ‘free- energy’ for your business.

02

Incentives

The Commercial Solar Investment Tax Credit (ITC) allows businesses to take advantage of a 30% deduction of the cost of their solar project investment as a credit against their federal tax liability. This tax credit steps down at the end of 2033, so the time is now to take advantage of the full 30%.

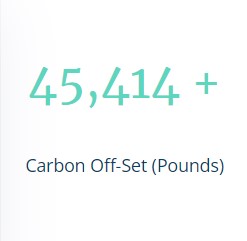

Sustainability

More and more businesses are adopting a ‘green’ initiative within their business model. Solar for your business as an investment shows that you are at the forefront of technology and have adopted an environmentally responsible approach for your business.

Businesses that Have Benefited from Commercial Solar

Commercial Solar Investment Incentives

Inflation Reduction Act

The Inflation Reduction Act allows Commercial solar customers to take 30% of their solar investment as a credit against their federal tax liability. The Inflation Reduction Act applies to the complete costs of commercial solar systems, and there is no cap on its value (though the Commercial solar customer must have a tax liability to benefit from a tax credit).

Accelerated Depreciation (MACRS)

Commercial clients may also benefit from accelerated depreciation (MACRS) on their Solar investment. After applying the 30% Inflation Reduction Act, 85% of the solar investment solar can be depreciated. Since the MACRS benefit is a deduction, the MACRS final cash impact depends on the companies marginal tax rate.

State Tax Credits

South Carolina business owners can take advantage of a 25% SC Solar Tax Credit to help cover the cost of their solar system. This is addition to the Inflation Reduction Act, letting SC business owners take up to 55% of the cost of their system in tax credits.

We partner with you to share the success of commercial solar

Since 2010 Renu has partnered with top businesses and non-profit organizations across the United States to share the story and benefits of solar. More and more businesses are able to make the move to utilizing the power of the sun to change the way they view energy usage and gain long term cost savings.

Commercial Solar Investment Incentives

Inflation Reduction Act

The Inflation Reduction Act allows Commercial solar customers to take 30% of their solar investment as a credit against their federal tax liability. The Inflation Reduction Act applies to the complete costs of commercial solar systems, and there is no cap on its value (though the Commercial solar customer must have a tax liability to benefit from a tax credit).

Accelerated Depreciation (MACRS)

Commercial clients may also benefit from accelerated depreciation (MACRS) on their Solar investment. After applying the 30% Inflation Reduction Act, 85% of the solar investment solar can be depreciated. Since the MACRS benefit is a deduction, the MACRS final cash impact depends on the companies marginal tax rate.

State Tax Credits

South Carolina business owners can take advantage of a 25% SC Solar Tax Credit to help cover the cost of their solar system. This is addition to the Inflation Reduction Act, letting SC business owners take up to 55% of the cost of their system in tax credits.

We partner with you to share the success of commercial solar

Since 2010 Renu has partnered with top businesses and non-profit organizations across the United States to share the story and benefits of solar. More and more businesses are able to make the move to utilizing the power of the sun to change the way they view energy usage and gain long term cost savings.

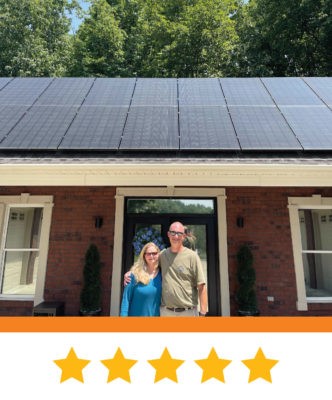

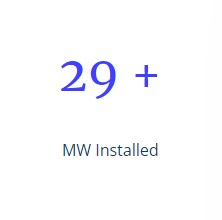

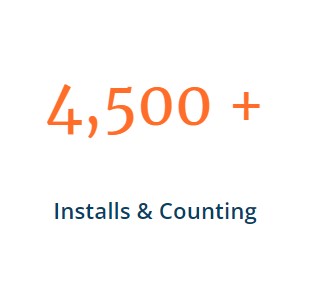

Renu Solar by the Numbers

We are very proud to share our achievements over the years.

Commercial Solar Stories

Why Renu Energy Solutions - Commercial Division

Renu Energy Solutions has installed over 5000 solar systems since 2010, and is an expert in the solar industry. Specializing in industry leading customer service, Renu is. a turn-key company. Whether you’re just beginning to research your solar options or you’re ready to install a system tomorrow, Renu will be your smart. reliable. solar partner from the first phone call to installation and system energization. Just a few of many reasons to consider Renu Energy Solutions for your next commercial project:

- North/South Carolina Commercial Installer

- Lower Business Operation Costs

- Licensed Rooftop/Electrical Technicians

With so many incentives to save money on your solar installation, contact us today to see how much you could save with solar!

Renu Commercial Solar Inquiry

Please fill out this quick contact form and let us know how we can help you!

"*" indicates required fields

Since 2010, Renu Energy Solutions has consistently been the solar installer you can trust.