Solar is more Affordable than you Think

The Inflation Reduction Act has been a major support for customers across the Southeast. Regardless of where you live in 2022, the Inflation Reduction Act provides a 30% federal tax credit until 2033 based on the total cost of your solar system. In 2033, the Inflation Reduction Act will reduce the residential solar tax credit to 26%.

The full, all-in costs of solar systems installed by Renu are eligible for the Federal Tax Credit along with independently installed energy storage units. If you choose Solar and Energy Storage from Renu, the full costs of both are also eligible for the Federal Tax Credit. However, your ability to benefit from the tax credit depends on your tax liability. Renu recommends that you speak to a tax advisor or professional accountant regarding your ability to take full advantage of the tax credit.

South Carolina Solar Tax Credit

South Carolina residents also benefit from a 25% State Tax Credit. Match this with Inflation Reduction Act program at 30% and South Carolinians can save up to 55% on the cost of their solar install for their home.

Why Renu Energy Solutions?

Our customers have received millions of dollars in federal and state tax incentives over the years of Renu’s operation.

With so many incentives to save money on your solar installation, contact us today to see how much you could save with solar!

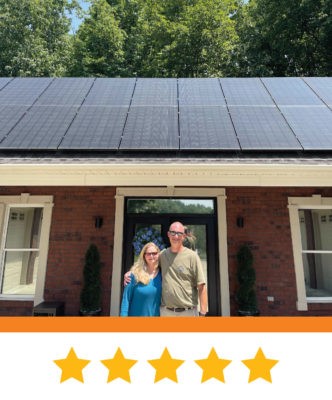

Renu has installed over 5,000 solar systems since 2010, and is an expert in the solar industry. Specializing in industry leading customer service, Renu is. a turn-key company. Whether you’re just beginning to research your solar options or you’re ready to install a system tomorrow, Renu will be your smart. reliable. solar partner from the first phone call to installation and system energization.

Get Started on Your Solar Journey...

Since 2010, Renu Energy Solutions has consistently been the solar installer you can trust.