by Renu Energy | Oct 10, 2022 | Renu Blog

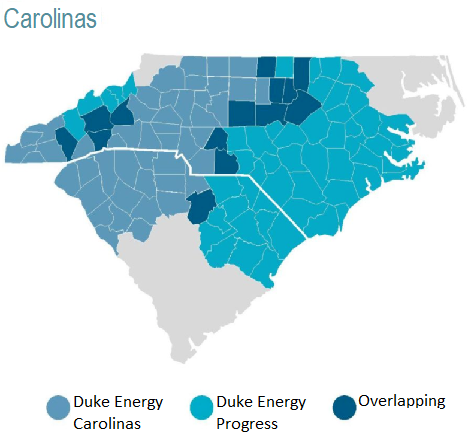

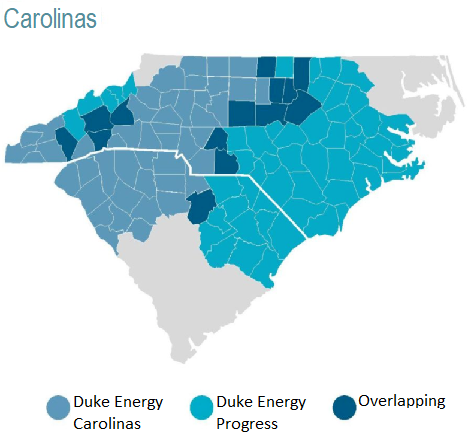

Duke Energy Progress requests North Carolina regulators for a three year, 16% rate hike for eastern North Carolina and Asheville. This increase would be the first multi-year rate increase from the utility company, resulting in $615 million in additional revenue. Introducing multi-year rates like this three-year rate proposal has been permitted under North Carolina’s energy reform law in 2021. According to Duke Energy Progress, the additional funds would help with preparing for more renewable energy, strengthening the grid, and improving energy reliability.

Each following year, these rates would rise from 8.5% in October 2023, 3.9% in October 2024, then 3.6% in October 2025. An average homeowner that uses 1,000-kilowatt hours a month would expect to have a monthly bill of $141.15 in 2025.

This increase would be an addition to a 9.8% increase request that would start on December 1st. Duke energy progress requested this increase because of the increase in natural gas prices.

Increases from this rate hike do not include the increases that have been proposed under Duke’s carbon plan. The North Carolina Utilities Commission must utilize a carbon plan by the end of 2022, and this plan might need rate increases of 27% over 10 years.

Along with eastern North Carolina and Asheville, Duke Energy Carolinas in Charlotte, Durham, Winston-Salem, and Greensboro may also seek a three-year rate hike in 2023.

by Renu Energy | Oct 7, 2022 | Renu Solar News

CHARLOTTE, N.C., Oct. 05, 2022 (GLOBE NEWSWIRE) — Renu Energy Solutions, a locally-owned and operated solar installer based in North Carolina and South Carolina, today announced its partnership with Tesla to bring its Solar Roof tiles to the Carolinas.

As the first certified Tesla Solar Roof installer in North Carolina, the Renu Energy Solutions team is now offering residential customers its innovative tiles made with tempered glass three times stronger than standard roofing tiles and engineered for all-weather durability. Renu is also among only a handful of certified Tesla Solar Roof installers in South Carolina.

To continue reading GlobeNewswire’s press release on Renu’s introduction of Tesla Solar Roof, click here!

by Renu Energy | Oct 4, 2022 | Renu Solar News

Rooftop solar power has become something of a frontier land rush as we shift to renewable energy to fight climate change. Hundreds of entrepreneurs, some with little or no experience, have flooded into the business. Advertisements promise free solar panels and zero-dollar energy bills. Lots of lies are being told, to take advantage of our good intentions.

You may have read the news recently about the collapse of Mooresville-based solar firm Pink Energy, formerly known as Power Home. David Hodges at WBTV reports that the company is shutting down.

The failure of the business leaves thousands of customers around the country stranded.

Please click here to read more on what Renu Energy Solutions President Jay Radcliffe has to say regarding solar red flags and solar service to those in need.

by Renu Energy | Oct 4, 2022 | Renu Solar News

Rooftop solar power has become something of a frontier land rush as we shift to renewable energy to fight climate change. Hundreds of entrepreneurs, some with little or no experience, have flooded into the business. Advertisements promise free solar panels and zero-dollar energy bills. Lots of lies are being told, to take advantage of our good intentions.

You may have read the news recently about the collapse of Mooresville-based solar firm Pink Energy, formerly known as Power Home. David Hodges at WBTV reports that the company is shutting down.

The failure of the business leaves thousands of customers around the country stranded.

Please click here to read more on what Renu Energy Solutions President Jay Radcliffe has to say regarding solar red flags and solar service to those in need.

by Renu Energy | Oct 4, 2022 | Renu Solar News

Rooftop solar power has become something of a frontier land rush as we shift to renewable energy to fight climate change. Hundreds of entrepreneurs, some with little or no experience, have flooded into the business. Advertisements promise free solar panels and zero-dollar energy bills. Lots of lies are being told, to take advantage of our good intentions.

You may have read the news recently about the collapse of Mooresville-based solar firm Pink Energy, formerly known as Power Home. David Hodges at WBTV reports that the company is shutting down.

The failure of the business leaves thousands of customers around the country stranded.

Please click here to read more on what Renu Energy Solutions President Jay Radcliffe has to say regarding solar red flags and solar service to those in need.